Authors:

Devon M. Jennings (Product Owner – Data & Open Banking Ingestion Technologies at Vanquis Bank)

Alex Alder (Senior Marketing Manager – NatWest Business)

Gurdeep Singh (Principal Software Engineer at Vanquis Bank)

What is Open Banking?

In 2016, the Competition and Markets Authority (the CMA) set the UK’s nine biggest banks a deadline of creating open source, open banking APIs. The core purpose of which was to increase innovation and competition within the UK banking market. The UK Open Banking Implementation Entity was formed in August 2016 and over the following months, ‘open data’ was launched as a concept and open banking standards were created and refined to help regulate and streamline the transfer of data between approved third-party providers (TPPs).

The Technical angle

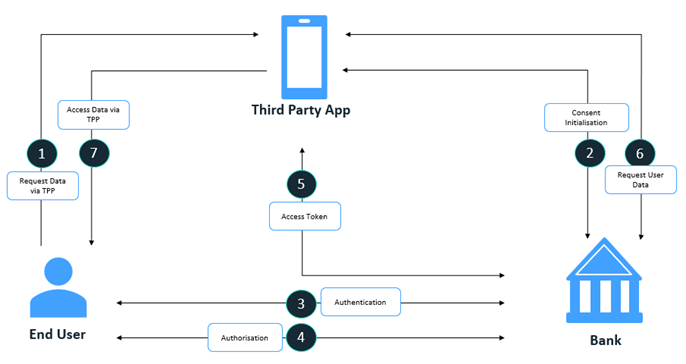

In the open banking eco-system there are three key players that interact with each other:

TPP – Third Party Provider

These are the financial applications that offers open banking-based features to the customers.

ASPSP – Account Servicing Payment Service Provider

These are the financial organisations that holds customer data e.g. Banks.

PSU – Payment service User

These are the customers using Third party applications and authorise their banks to share their data with those third parties.

Open Banking eco-system is based on the O-Auth 2.0 protocol. The following workflow diagram explains how these interacts in the system.

How it works

- Customers request their data via third party application

- Third party application connects with Bank to initialise the consent flow

- Bank asks customer to authenticate login. This can be any form e.g. traditional username & password, face ID, Thumbprint etc.

- Customers provide the consent to bank so that the data can be shared with third parties

- Bank issues the access token to the third parties. This is encrypted data that contains user and third-party information.

- Third parties then use this access token to get access to the customers data from Bank via open banking APIs

- Finally, Customer can view their Bank data on the third-party application.

We considered multiple options for introducing open banking and agreed that integrating a product with a rich product roadmap into our digital platforms would ensure we could get to market quickly. Enter Payit™ by Natwest...

What is Payit? – How it adds value to Vanquis

Payit™ is a new NatWest innovation, developing new payment technologies based on open banking, to offer a fast, simple and safe ways for consumers to make and receive payments online. Although Payit™ is developed by NatWest, our customers don’t need to bank with NatWest to use it.

Using Payit™, our customers can make payments towards their available credit and balance within the mobile app without the use of their debit card. The solution also provides them with full visibility and choice over the account they use, so they can see their account balance before confirming the transaction. And finally, customers benefit from instant updates to their available credit as well as next working day updates to their balance – something that is not possible if they make payments with a debit card.

So far we’ve seen positive customer feedback, with Payit™ journey completion sitting at 80%. This is above industry averages and similar return/repeat payments behaviour with those customers.

Using Open Banking in our onboarding journey

Over the last couple of years we’ve launched multiple POCs (proof of concepts), with a selection of customers and in partnership with credit referencing agencies, to implement open banking into our onboarding journey.

The aim was to improve the customer journey in cases where they would usually need to provide copies of their proof of income to increase their chances of being accepted for a credit card. They could instead provide a snapshot into to their bank account in just a few taps/clicks, therefore providing us a more detailed insight into their income and expenditure.

We saw huge improvements with the use of open banking:

- an improved customer journey

- an improved onboarding experience

- a much faster decision made, than when they previously had to send in proof of income documents via SMS or post

- improved operator efficiency due to less time spent reviewing documents and chasing applicants if they hadn't uploaded the required documents

- a reduction in potential fraud, as it removed the possibility of an applicant uploading fraudulent documents, where we're connecting directly to the applicants’ authenticated bank account

Where we want to go next

The POCs (proof of concepts) have successfully completed, and we're moving forward with making these innovations available as standard within our onboarding journey.

Harnessing the power of the Payit™ product, we're looking to allow customers to make a payment using a secure link sent via email and in some cases, even SMS. We also want to allow for our customers' preferred bank to be remembered for future payments, to further optimise their payment experience. And finally, we'd like to introduce variable recurring payments without the need for customers to sign into their bank account.

On a final note...we’re hiring!

Come and join our journey, and help shape the future of open banking or any other innovative technologies at Vanquis.

Check out our current vacancies or follow us on Linkedin.